June 2012

Dear Reader,

If you want to know the future of market research, forget about what the futurists and the innovation gurus have to say. Instead, listen to what future marketing and business professionals have to say.

That’s what Versta Research did with a recent survey of business students about market research. We interviewed MBA students and undergraduate business students about how and whether they will use research in their future careers. Their overwhelming sentiment? They value research a lot, but few enjoy the difficult and demanding work of actually doing it themselves.

Other items of interest in this newsletter include:

- Doing Research with Made-Up Numbers

- Ten Books about Research for a Deserted Island

- Why Cost Matters with Online Panel Surveys

- Six Ways to Identify Bad Survey Data

- Avoiding Phony Precision in Your Press Release

- Research Makes Cross-Selling More Profitable

- How to Make a Beautiful Market Share Chart

- Consumers Eagerly Answer What You Don’t Ask

- Why Every Business Needs the Census Bureau

- 60 Million Surveys Is Too Many

- Five Classes to Make You Smarter

- What Statisticians Really Do

- Bad Charts and Good Charts for Kony 2012

- Your Customers DO Care about the Numbers

If you ever thought to yourself, “You know, I could do this, but it sure would be nice to have an expert team tackle this for me,” then give us a call at 312-348-6089 for the best that the future of research has to offer.

Happy Summer,

The Versta Team

Next Generation Survey on Research: Just Do It for Me

With all the belly aching among researchers about do-it-yourself (DIY) research tools degrading the quality of our work and putting research firms out of business, Versta Research thought it would be instructive to ask the next generation of marketing and PR professionals how they feel about market research. What do they value, or not value, about market research, and how do they see themselves doing research and using research in their future careers?

We had our chance in April when I was back in the classroom for a few hours as guest speaker at the University of Illinois in Chicago. My task was to provide an insider view of market research to MBA and undergraduate business students, and to talk about the transition from academics to the world of business. I leveraged the occasion with a survey of 53 students enrolled in both graduate and undergraduate market research classes.

Research Is Valued, but Few Want to Do It Themselves

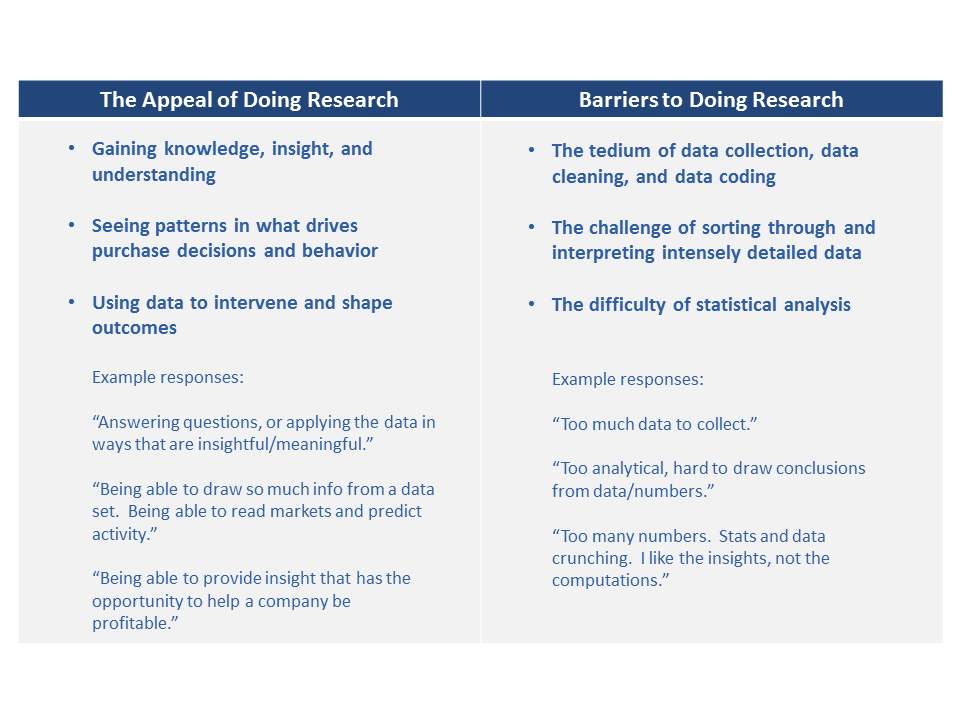

Students value and get excited about the outcomes of research. But they see the process of getting there as difficult. Few want to do it themselves. In open-ended format, students outlined the pros and cons of doing market research themselves.

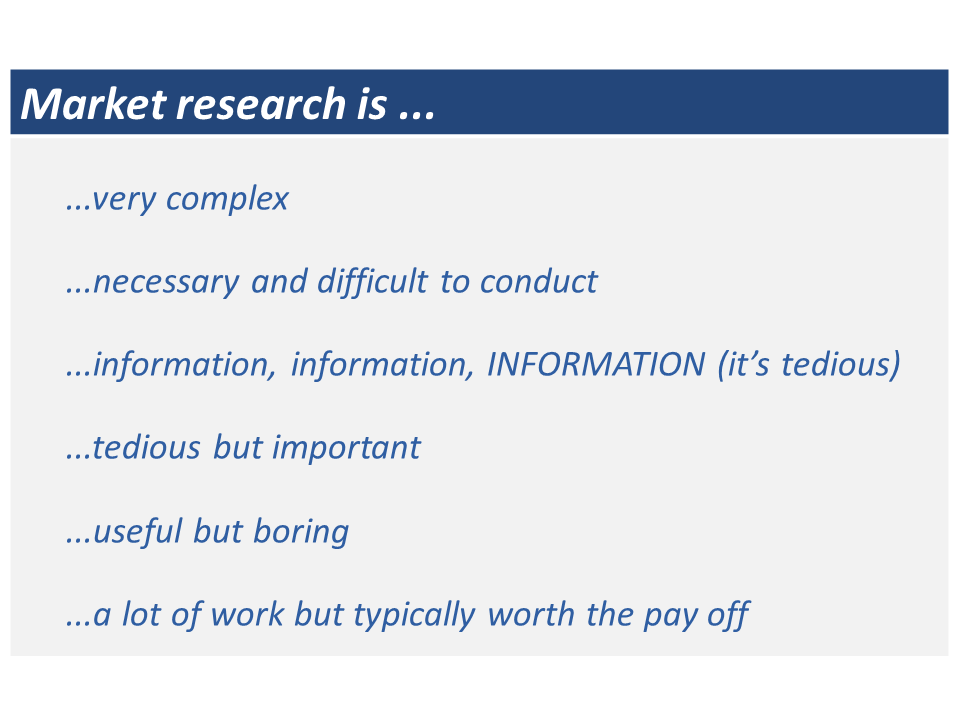

We asked students to “free associate” with their opinions, thoughts and perspectives by completing the sentence “Market research is ______________.” Two themes dominated. First, market research is beneficial, important, and valuable, noted by 27 out of 53 respondents. Second, market research is tedious, difficult, lengthy, hard work, confusing, and or complex, noted by 30 students.

Some students find excitement in the tension between difficult research and what it can deliver, with one in twelve (8 percent) planning careers in market research. But they are far outnumbered by those who feel that market research, though valuable, requires talents, skills, and interests they do not have.

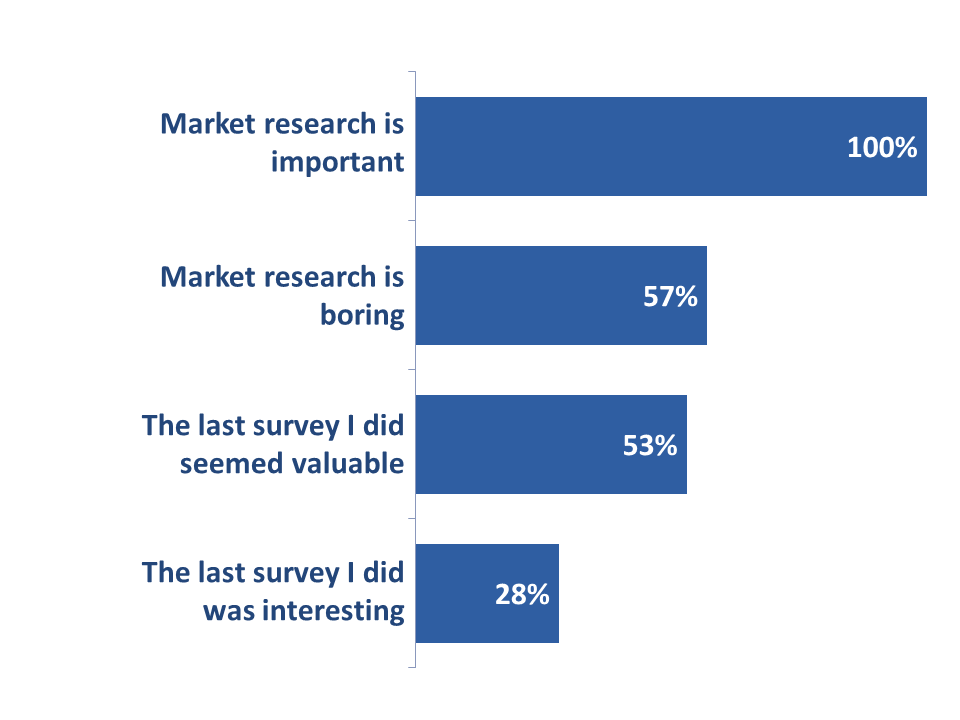

The survey also highlights a critical challenge for market research, which is that of relevance. More than half of students (57 percent) feel that market research is boring, even if it is important. In addition, many have experiences that call into question the value of research. When asked to think about their most recent survey experience as a respondent outside of class, only half (53 percent) believed it was likely to provide valuable information and just one in four (28 percent) found the survey interesting.

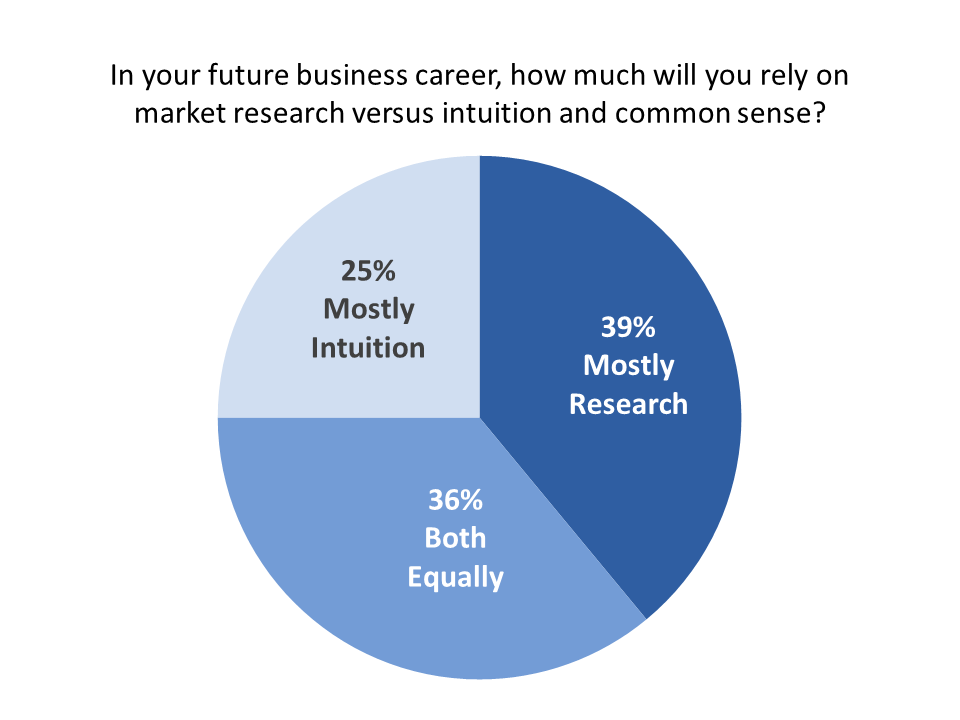

Research Edges Out Intuition

Ultimately, do today’s students see themselves relying on market research in their future roles as business professionals? The answer is yes. Three-quarters (75 percent) expect to rely on research as much or more than they expect to rely on intuition and common sense in their future business careers. Even among the one-quarter who see themselves following mostly business intuition, all agreed that research is important for today’s businesses, with nearly two-thirds (62 percent) believing it is very important.

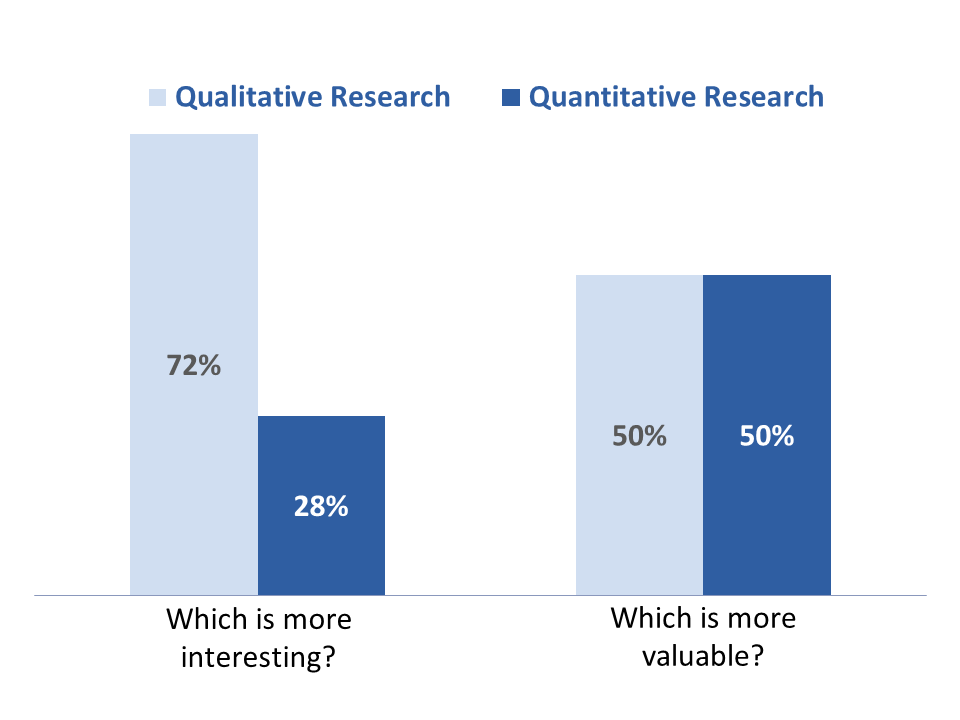

Qualitative researchers may have an easier time reaching these future business professionals compared to those of us who focus mostly on numbers. Three out of four survey respondents (72 percent) see qualitative research as more interesting than quantitative research. But students are equally split on which of the two approaches is more valuable.

Even “Simple” Research Is Not Easy

I rarely have sympathy for pundits who decry the proliferation of DIY research tools and tighter research budgets. Technologies allow cheaper, more efficient work than in the past, and good researchers should take advantage of that on both the vendor side and the client side.

Plus, good researchers know that while DIY research tools make some things easier, technology will never remove the inherent complexity of research or the rigorous effort involved in executing research. Even with simple DIY tools, statistics are not easy (no matter how many automated dashboards you have), and they are devilishly difficult to communicate in clear and compelling ways. Today’s business students (i.e., tomorrow’s business professionals) know that.

Versta Research’s next generation survey shows that today’s business students know that good research begets valuable knowledge, which gives them the power to make smarter decisions. Our job is to help this next generation of marketing and communications professionals with the power of research to make those decisions with whatever tools, technologies, and expertise we can offer.

Stories from the Versta Blog

Here are several recent posts from the Versta Research Blog. Click on any headline to read more.

Doing Research with Made-Up Numbers

A Dilbert cartoon jokes that made-up numbers are as useful as accurate numbers, which is true if your research is never used at all. You can avoid this fate!

Ten Books about Research for a Deserted Island

Which books or resources would you recommend to a colleague who needs to build a small library of essential works in research methods? Here are ten suggestions.

Why Cost Matters with Online Panel Surveys

An industry study has revealed serious problems in quality and panel management among some well-known and widely used online panel providers. Paying for panel quality is worth it.

Six Ways to Identify Bad Survey Data

This article outlines six tell-tale signs that a respondent to an online survey is providing bad data. Use these signs to flag respondents who should be removed.

Avoiding Phony Precision in Your Press Release

Reporting numbers from survey research to the tenths or hundredths of a percent is misleading because it implies a level of accuracy that is almost impossible.

Research Makes Cross-Selling More Profitable

Instead of cross-selling to all your customers, it is better to segment them on key behavioral traits because a significant portion will actually drain profits.

How to Make a Beautiful Market Share Chart

R is an open-source, free, statistical computing software system that lets you make intuitive and useful charts showing shifts in market share. Here is an example.

Consumers Eagerly Answer What You Don’t Ask

“Response substitution” bias can mess up your customer satisfaction data because people are eager to share their overall opinions. There is a simple solution.

Why Every Business Needs the Census Bureau

The US Census Bureau and other agencies provide useful data and innovation that we leverage for nearly every customer and market research project. Here’s how.

60 Million Surveys Is Too Many

Some research technology companies pride themselves on fielding millions of surveys, despite it being unnecessary, costly, and harmful to future response rates.

Five Classes to Make You Smarter

To stay at the cutting edge of methodologies for market research, we recommend these short, intensive, academic courses that will provide rigorous training.

What Statisticians Really Do

Market research too often involves creating a lot boring data tables and charts. The key to making statistics useful is to turn all that data into stories.

Bad Charts and Good Charts for Kony 2012

Unlike the video, the Kony 2012 team failed to tell a compelling financial story because of a poorly designed data chart. Here are two better alternatives.

Your Customers DO Care about the Numbers

Contrary to what some argue when it comes to presenting market research, we find that most clients care a lot about numbers as long as the numbers tell a story.

MORE VERSTA NEWSLETTERS